Accelerating application processing by 1200% without hiring a single new underwriter.

Carputty

July 2023 - September 2023

Lead Product Designer

Director of Product , 3 Engineers, and COO

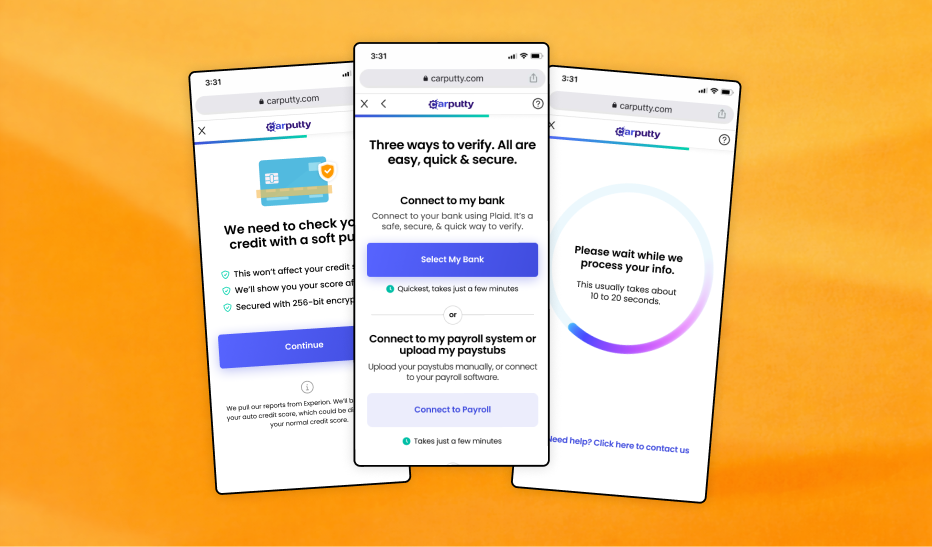

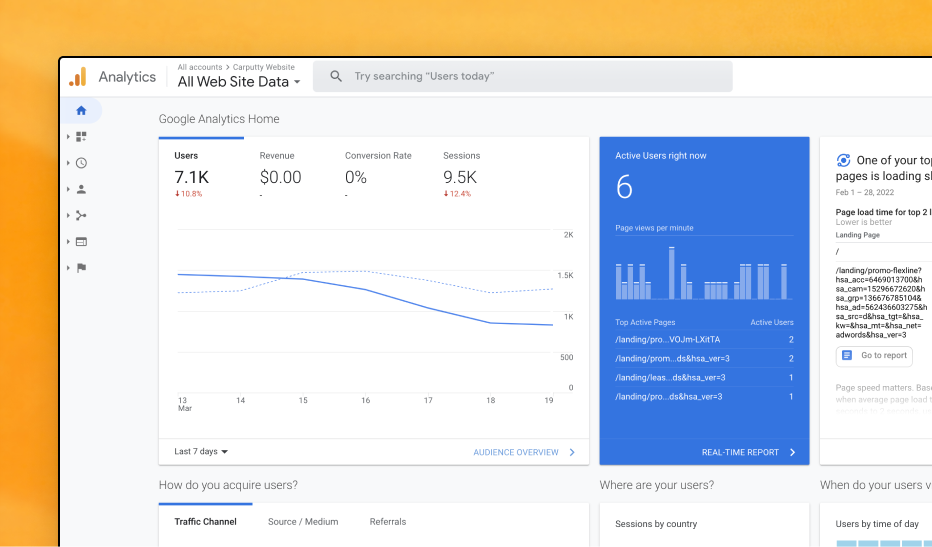

In 2022, Carputty was disrupting auto financing with a flexible "Line of Credit" model. But the product was almost too successful. As marketing ramped up, applications poured in—and immediately hit a wall.

The team could only process 8% of daily applications.

92% of customers were left waiting indefinitely.

We were losing qualified borrowers to competitors simply because we couldn't say "Yes" fast enough.

The business faced a critical choice: hire an army of underwriters (expensive, slow) or fundamentally redesign the engine. With the backlog growing by the hour, we didn't have time to guess. I partnered with the Product Lead to initiate a rapid "Diagnostic Sprint," utilizing the Double Diamond framework to widen our understanding before narrowing in on a fix.

I conducted 12 hours of deep-dive shadowing with the underwriting team. I pulled up a chair next to the Lead Underwriter and simply watched her work.

80% of the operational drag came from a single step: Income Verification.

Standard W-2 employees were easy to verify. But gig workers (Uber drivers, freelancers) broke the system. Their income arrived in irregular deposits that the rules engine couldn't parse, forcing underwriters to download PDF bank statements and manually calculate totals.

The problem wasn't the people; it was the tooling. We didn't need full automation (which is risky in lending); we needed Augmented Intelligence—a system that pre-processed the data so humans could make faster decisions. This insight shifted our entire focus: we realized we didn't need to replace the underwriters; we needed to build a tool that could "read," organize, and present these messy statements for them.

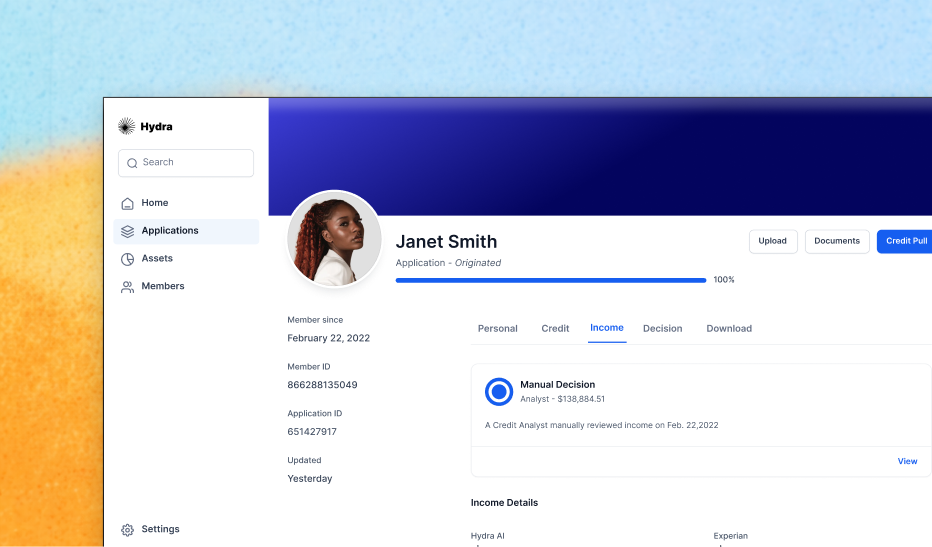

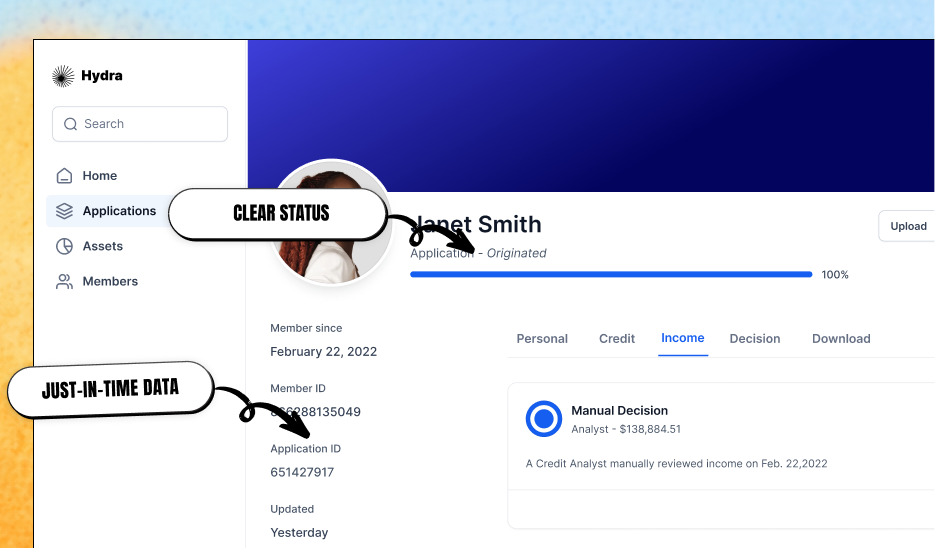

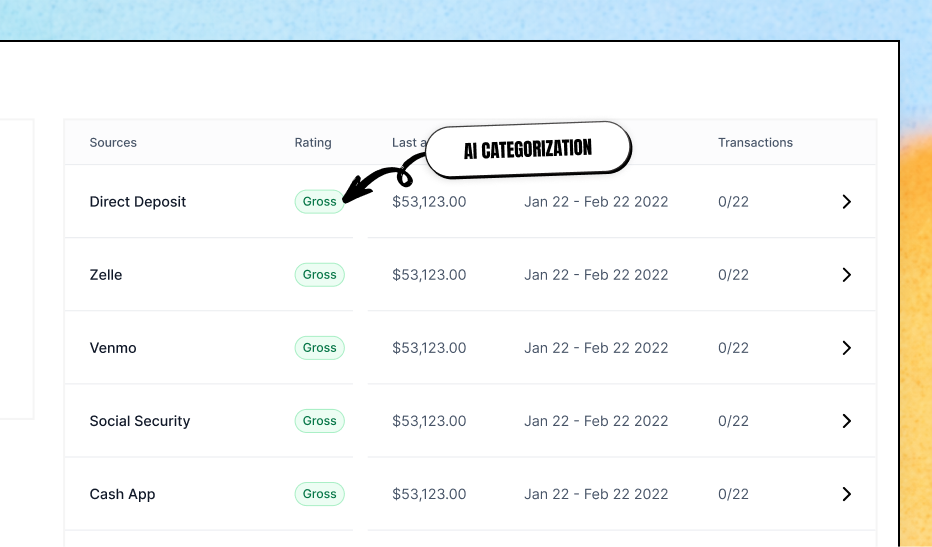

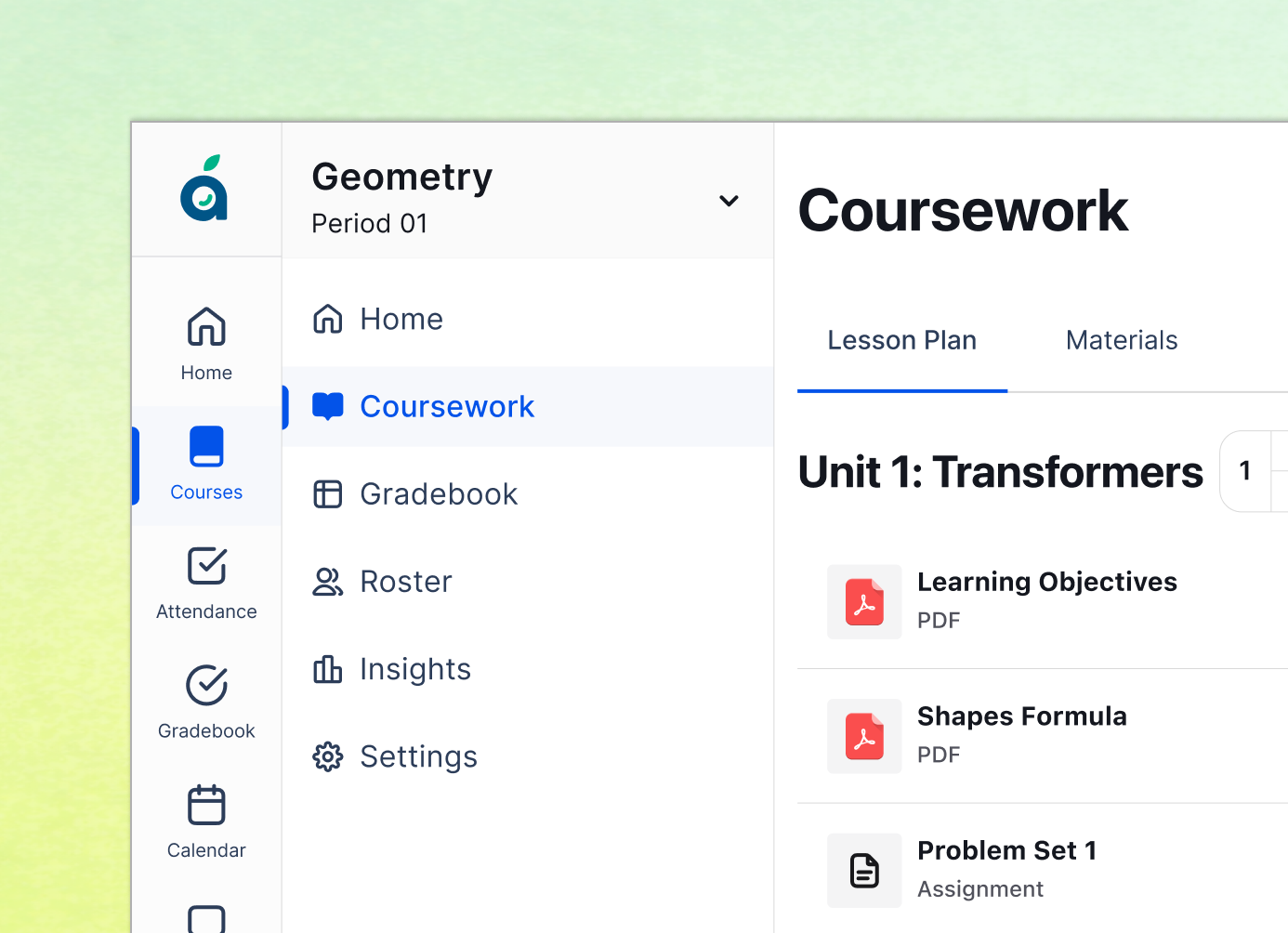

The core design challenge was building Trust. If the AI made a recommendation, the underwriter needed to verify it instantly without re-doing the math to check the work. I implemented a "Transparency" strategy—making the AI's logic transparent rather than hidden. Instead of just presenting a final income number, I designed the UI to "show its work." If the system labeled a deposit as income, it displayed the specific source data right next to it (e.g., "Recurring Deposit: $450 from DoorDash").

This effectively changed the underwriter's role from "Data Entry" to "Quality Assurance," reducing the cognitive load from calculation to simple verification.

Crucially, I designed this interface to function as a real-time data labeling tool. This was the long-term strategic play: every time an underwriter clicked "Confirm" or "Reject" on an AI suggestion, that interaction was fed back into the model. This created a virtuous cycle where the act of doing the work actually improved the tool. As the underwriters processed loans, the model grew smarter, eventually becoming confident enough to auto-verify standard cases. This allowed us to slowly remove the human from the loop for the easy tasks, reserving their expertise for the complex edge cases that truly required human judgment.

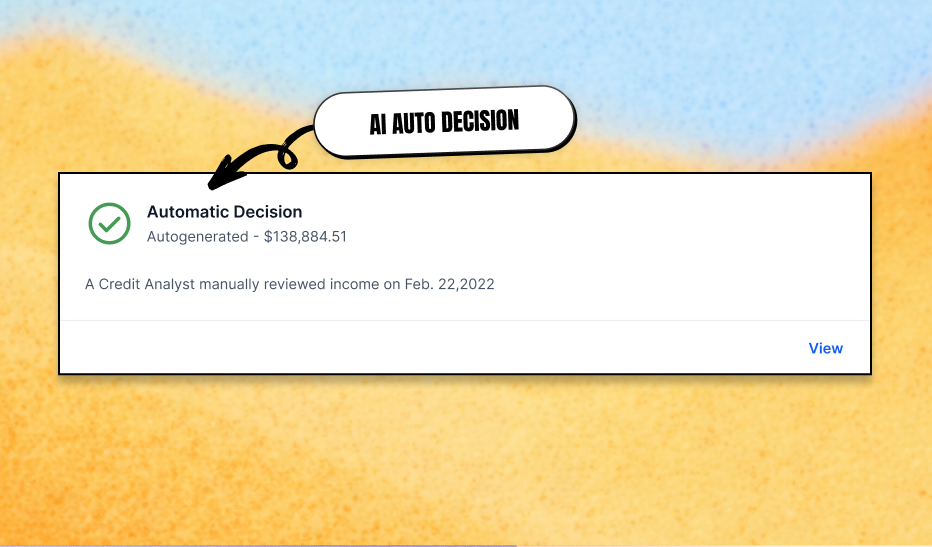

Once the training loop had processed enough data, we reached a strategic tipping point. The system wasn't just guessing anymore; it was predicting with high accuracy. This allowed us to introduce Auto-Decisioning, but we did so cautiously to maintain stakeholder trust. I designed a "Confidence Threshold" control that allowed the Risk Team to dial in their comfort level. If the AI's confidence score for an applicant exceeded a specific benchmark (e.g., 98%), the system was authorized to bypass the manual review queue entirely.

This changed the fundamental nature of the underwriter's day. Their inbox transformed from a flooded firehose of every single applicant into a curated stream of only the most complex cases. The "easy" W-2 applications were processed instantly in the background, invisible to the staff. The UI shifted from a high-volume processing tool to a deep-dive investigation platform, respecting the underwriters' expertise by only interrupting them when human judgment was truly necessary.

In just three weeks, we deployed the new system. The results were immediate and measurable.

In just three weeks, we deployed the new system. The results were immediate and measurable.

Next Case Study

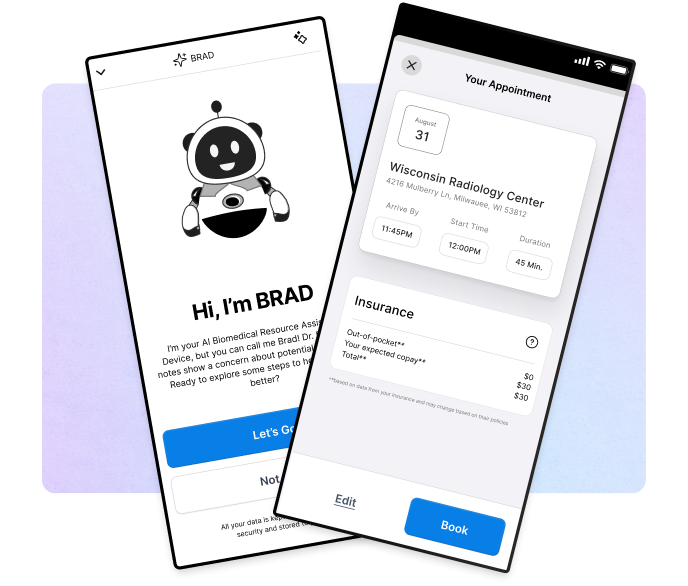

How I designed a 'Safe AI' framework to decode clinical jargon, establishing the UX patterns that now power the organization's internal intelligence engine.

Clearing a 92% backlog by designing a 'Glass Box' AI interface that increased application processing speed by 1200% in just three weeks.

"Designing the first 'Dynamic CVV' experience that bridges the physical and digital worlds, reducing card-not-present fraud by over 95%